salt tax cap mortgage interest

This was true prior to the SALT deduction cap and remained the case in 2018. If you buy a home between now and 2026 you can deduct the interest on up to 750000 in mortgage debt used to purchase or improve it as an itemized deduction.

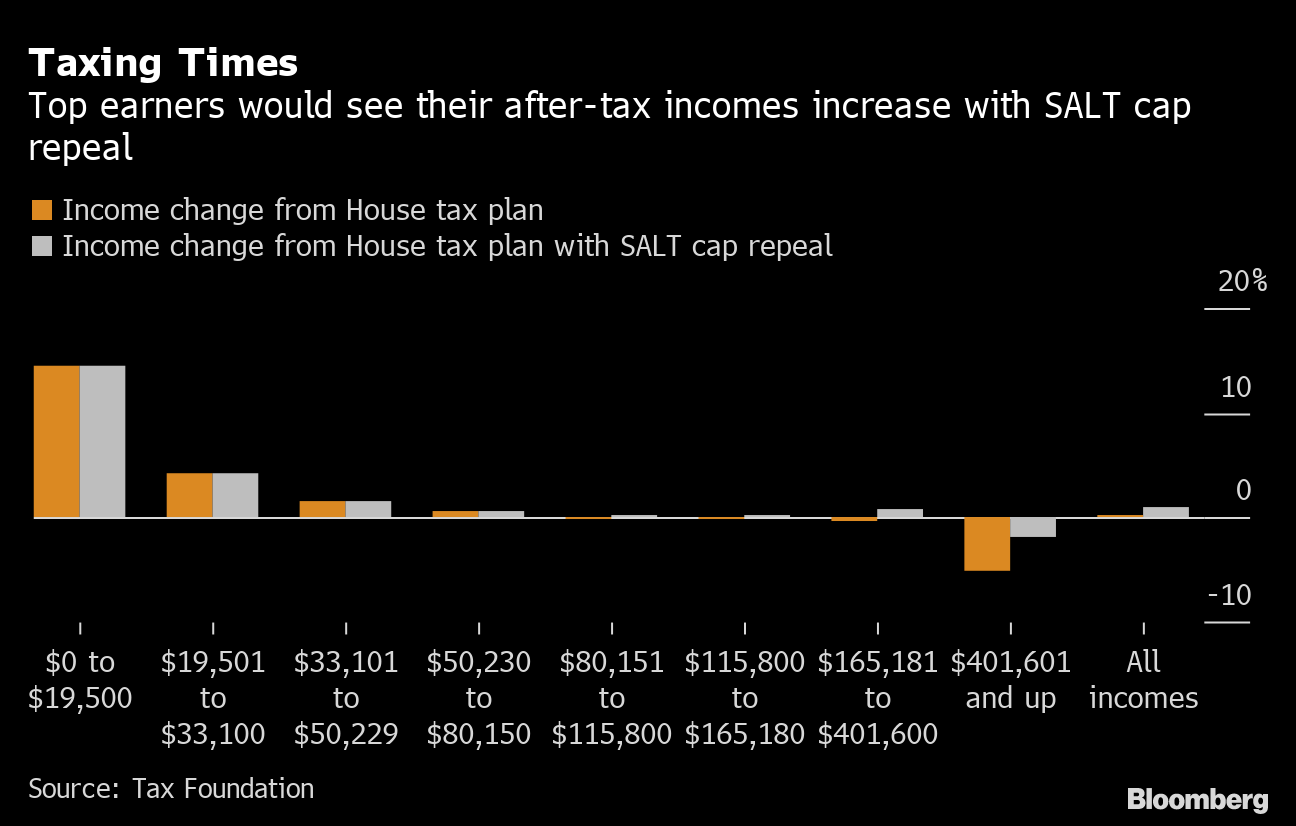

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

Other expenses that you might be able to.

. Only 21 used the SALT deduction for mortgage interest and 15 used the deduction for charitable donations. While the deductibility of mortgage interest moves the tax treatment of residential real estate closer to a consumption tax there are still critiques of the MID. The expansion of the standard deduction further limited the value of the SALT deduction for taxpayers under the 10000 cap.

What counts Before the 2018 tax year homeowners getting a new mortgage were allowed to deduct interest paid on loans of up to 1 million secured by a principal residence or second home. Under the new tax laws SALT deductions are limited to an aggregate of 10000 for joint filers. How Do Taxpayers Benefit from the SALT.

The SALT deduction tends to benefit states with many higher-earners and higher state taxes. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent. The cap on mortgage-interest deduction drops from 1000000 to 750000 or 375000 if you use married filing separate status.

Also deduction for mortgage interest was truncated under the new law. The TCJA also made it harder for homeowners to maximize the mortgage interest tax deduction by limiting the deduction for state and local income taxes SALT to 10000 when there was previously. Below you can see how often SALT deductions are claimed in your area to see if this will impact you.

While the Tax Cuts and Jobs Act placed a 10000 cap on the SALT deduction its only temporary. Jeff will be able to deduct 5775 3000 2500 275 on Schedule A. Compared with other common deductions the state and local tax deduction had a larger impact than the deductions for both charitable giving and mortgage interest.

The mortgage interest deduction. The cap applies to taxable years 2018. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly. This was due not only to the SALT cap but also to the large increase in standard deductions from 12700 to 24000 for most married couples. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately.

High-income taxpayers are more likely to itemize their returns and are often the main beneficiaries of this deduction. Numerous minor changes the narrowing of the. In fact the Congressional Budget Office estimated.

This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. New Tax Law on SALT. Ergo any SALT payments in excess of the 10000 threshold become ineligible for deduction on federal tax returns.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Sales tax paid on new truck. However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers.

Along with the mortgage interest deduction the non-taxation of employer-sponsored health benefits and pension benefits preferential tax rates on capital gains and the tax deferral of corporate profits earned abroad the SALT deduction costs the federal government trillions in missed revenue opportunities. Remember that he can deduct either state and local income taxes OR sales tax not both. In addition to changing the standard deduction the Tax Cuts and Jobs Act reduced the principal-balance limitation for the mortgage-interest deduction to 750000 375000 for couples filing.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. But remember that Jeffs standard deduction is 12200. The federal tax reform law passed on Dec.

The TCJA limited the SALT deduction to 10000. 54 rows In 2018 only 321 percent of those filers itemized. The mortgage interest tax deduction allows homeowners to deduct from their taxable income some or all of the interest they pay on a qualified home mortgage loan.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017. In recent years 295 of tax units used the SALT deduction. Given that 10000 cap on the SALT deduction you would need to find more than 2200 in deductions elsewhere to justify itemizing on your tax return.

Annual vehicle registration fee for new truck.

Isurveyor Com House Survey Property Valuation Surveyor Search London Uk Property Surveyor Property Valua Property Valuation Surveying Property Values

Are You Searching Home Loan Service Provider In Ghaziabad 住宅ローン 銀行 ライフプランナー

Capital Gains Tax On Real Estate 4 Common Misconceptions Money Matters Trulia Blog Capital Gains Tax Capital Gain Real Estate Courses

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

Waterstone Mortgage To Manage Qc Audits Using Trk S Insight Rdm Send2press Newswire Positive Psychology Conference Themes Networking Opportunities

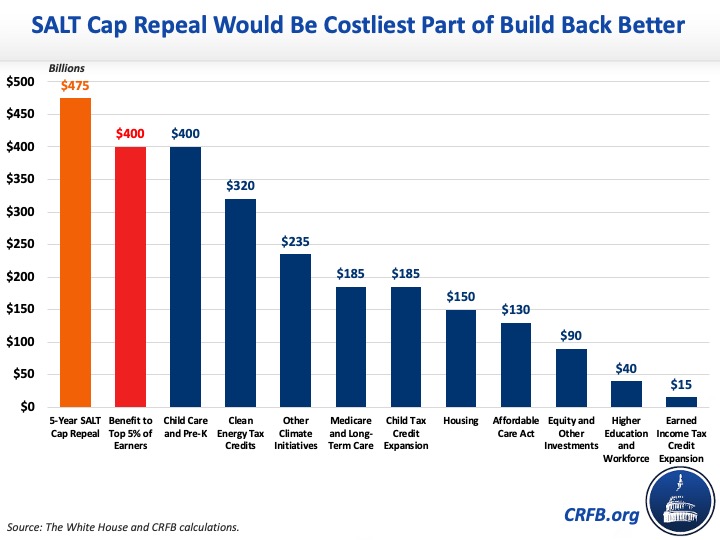

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Free Download Real Estate Capitalization Rate Cap Rate Calculator For Excel Free Download With Sensitivity Matrix Mortgage Calculator Capitalization Rate Money Management Books

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

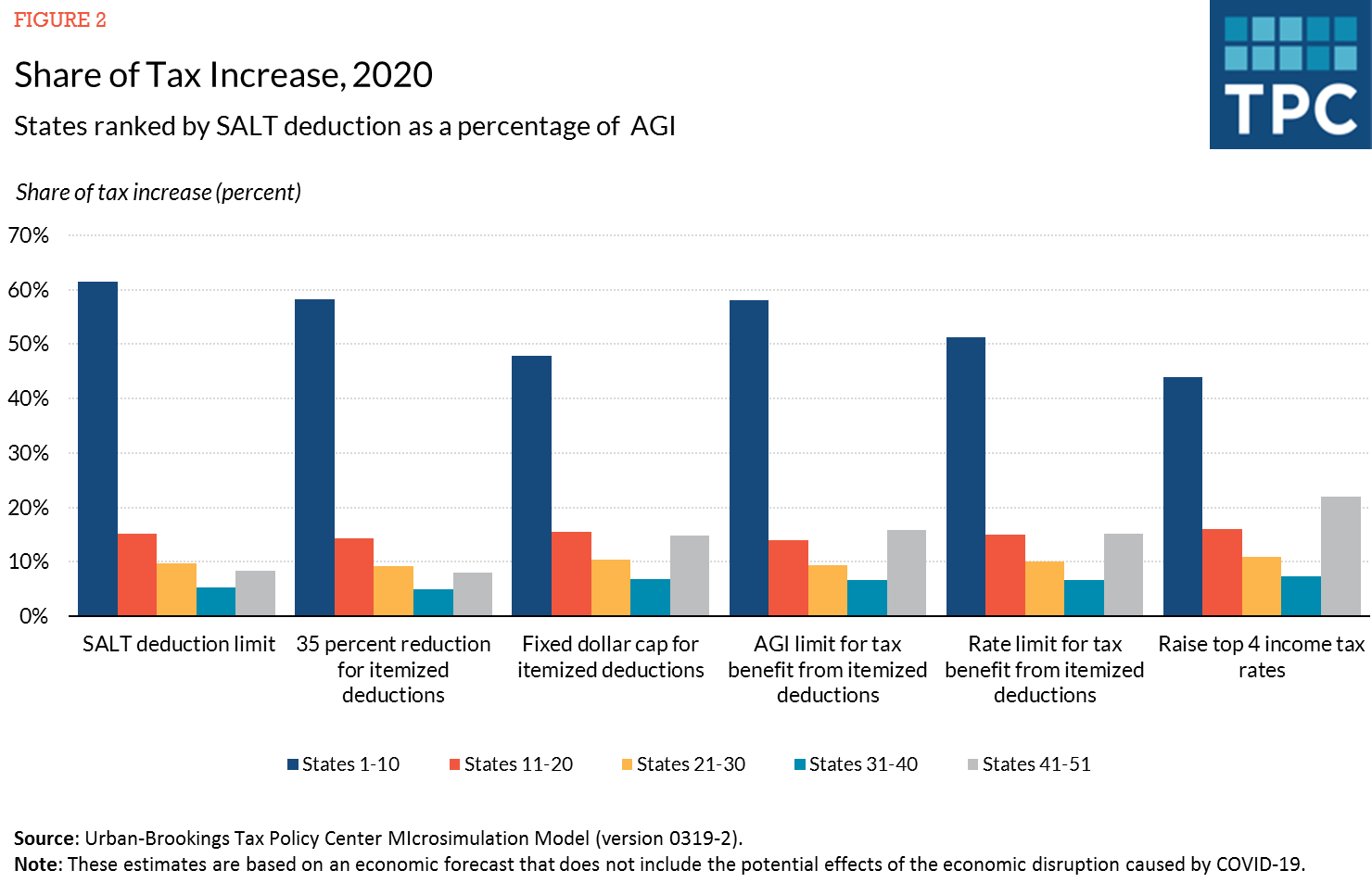

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Comparison Of Common Loan Programs Conventional Fha And Va Loans Closedis Va Home Loan Watch This Before A Va Loan Refinance Mortgage Conventional Loan

Matthew Ledvina Moved To Wealth Management Best Life Insurance Companies Life Insurance Policy Life Insurance Companies

Five Ways To Save For A Home Loan Visual Ly Home Loans Home Improvement Loans Loan

State And Local Tax Salt Deduction Salt Deduction Taxedu

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Ep158 How To Defer Taxes Forever With Real Estate Interview With Leonard Spoto Real Estate Investing Real Estate Deferred Tax

How And When To File A Superseding Tax Return The Wealthy Accountant Tax Return Accounting Accounting Career